Entrepreneurial Pursuits

With 20 years of experience in business advisory and a strong accounting background, Dean has honed his entrepreneurial side and regularly is involved in business projects with the DRM Group of Companies. Entrepreneurial involvement spans from private and peer-to-peer lending opportunities in a variety of business projects across and including operational advisory for those projects around Australia and globally. Like all the business Dean does, a large consideration is the human element of how these projects are approached and negotiated and so Dean is always happy to discuss conscious applications and tools with other entrepreneurs and budding business people

Recently

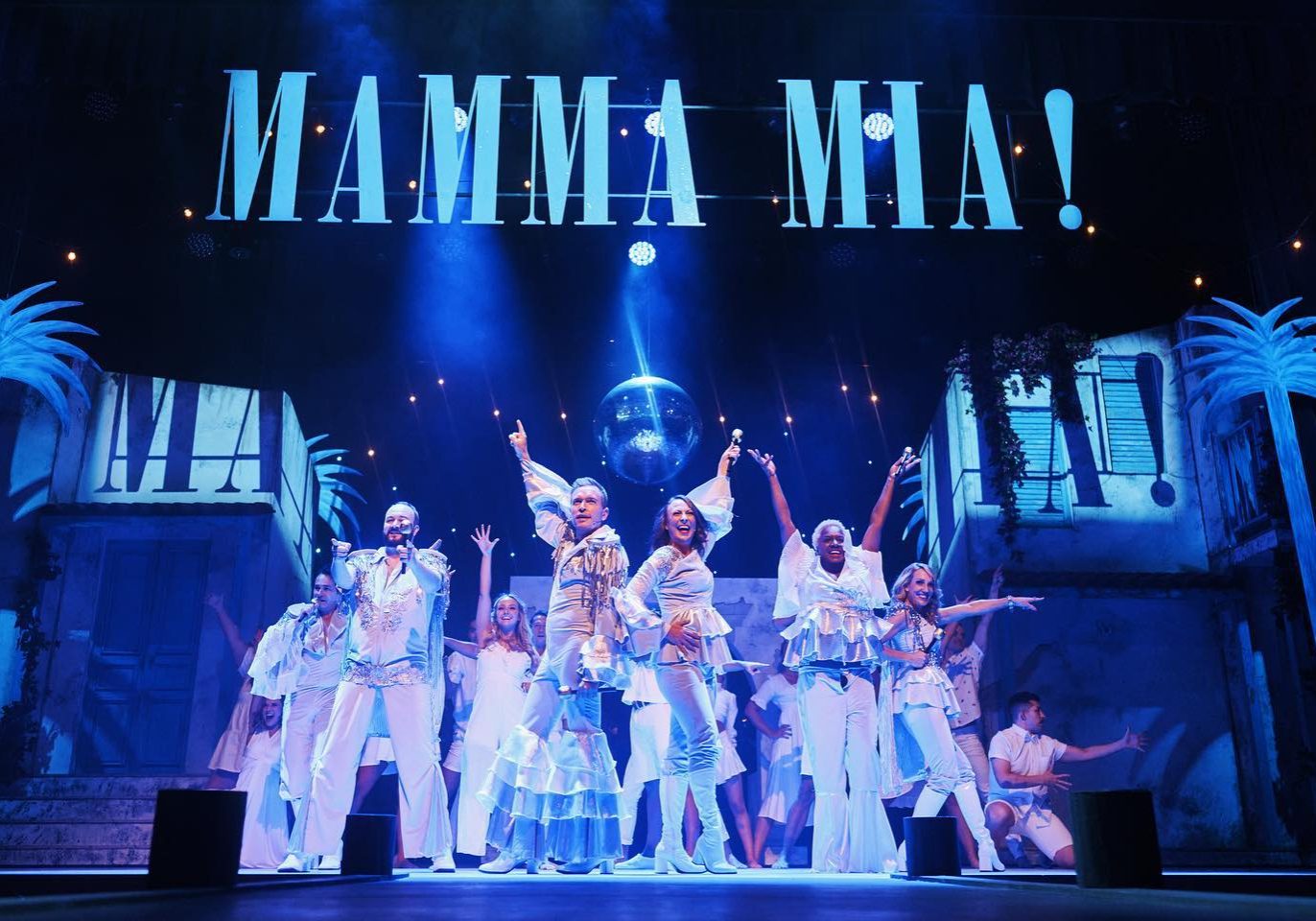

Musical Theatre Production

Investment and sponsorship in musical theatre production has become a staple part of entrepreneurial projects for the DRM Group of Companies since 2016, happily supporting producers to be able to bring creative works to local area and provide opportunities to local artistic talent to not only perform, but in all surrounding architecture of a production. We’ve been able to collaborate in Griffith University’s Centre for Creative Industries with our musical production clients to further involve the grass roots artistic local talent into the world of musical theatre production, with an element of entrepreneurial exposure. Our role and experience in this specific pursuit is in sponsorship, project lending and it’s associated security measures, as well as specific business advisory and cashflow projection budget management. Teaming this with our already honed accounting and taxation skills in practice, we work with musical producers who achieve satisfying financial outcomes for themselves and us.

Mining Technology

DRM Capital as part of the DRM Group of Companies has been involved in mining projects both as a lead venture capitalist and business advisor since 2018. Within those roles experience spans varied complex project and private loan models, their related securities and nuisances both here in Australia and the USA, and negotiating terms of those instruments at a high net value and very short time period. Consequently our involvement in these projects as a venture capitalist or private lender always include an element of business advisory from ourselves, ultimately keeping control of higher risk opportunities but also ensuring our working partners benefit financially from our relationship as much as we do.

Peer to Peer Lending

Peer to peer lending is what we see as the forefront for ‘Uberisation’ of the lending and money markets. With the opportunity to cut out large institutions lending your own money on appropriate platforms or privately to other credit worthy borrowers yields an interest rate far in excess of any institutional provider. Of course security and credit value of the borrower is of importance and so we only embark on this method of lending generally between other large projects for a money park, and, either through a platform that is regulated or with businesses and colleagues that we already have a solid working relationship with.

Property Development

Property Development opportunities represent specialised funding requirements due to varying security and control considerations, and also require specialised contract and budget control as they go through to completion stage. We’re experienced in negotiating complex arrangements and joint venture situations, on behalf of investors and collaborating with turn key builders to formulate a whole of project financial scope. Of course the time to construct and the resulting turbulence of the real estate market make this type of opportunity of high risk, however there are varying opportunities to exit such a project we can work with. We’re also in a position to assist on project management, particularly with the backbone of our accounting practice experience, and general organisation and coordination of the timeline utilising a Gantt Chart.